For many, Pokémon cards are more than just a nostalgic hobby, they represent a tangible asset with significant investment potential. For collectors in the United States, Japanese Pokémon cards are increasingly recognized as a particularly astute investment choice. This growing trend is driven by a combination of factors, including their superior quality, inherent exclusivity, and a burgeoning demand from Western collectors. Understanding these underlying drivers is key to building a successful Pokémon card investment portfolio.

The Pillars of Japanese Card Value

The investment value of Japanese Pokémon cards rests on several fundamental pillars that differentiate them in the global market.

Superior Print Quality: Japanese cards are consistently lauded for their "sharper printing, better centering, and cleaner holo patterns". This meticulous manufacturing process results in cards that are not only more aesthetically pleasing but also have a significantly higher likelihood of achieving top grades, such as a PSA 10. This inherent quality directly impacts their long term investment potential, especially for graded cards. Since high grade cards command substantial premiums, the superior quality of Japanese cards makes them a more reliable candidate for high value graded investments compared to English cards, which are often noted for "terrible quality control" and being "harder to get a 10". This translates to less risk when purchasing raw cards with the intention of grading them.

Exclusive Designs and Early Releases: Many Japanese sets feature "alternate artwork" or are released significantly "earlier" than their English counterparts. This first mover advantage and the presence of Japan exclusive cards or unique design elements, such as the Master Ball Reverse Holos in the Japanese 151 set, contribute to their inherent rarity and desirability. These exclusive offerings ensure that certain Japanese cards will always hold a unique place in the market, driving their value.

Lower PSA Population Reports: Generally, Japanese cards have "smaller print runs" and are "harder to find in the West". This lower supply, particularly of high grade copies, creates a powerful investment catalyst when combined with increasing Western demand. When supply is limited and demand grows, prices naturally appreciate. The fact that "demand for Japanese Pokémon cards is outpacing English releases" specifically because "Western collectors are increasingly targeting Japanese exclusives" indicates a fundamental and sustained shift in market preference, suggesting continued appreciation for these assets.

Current Market Trends: Why Now is the Time

Several current market trends make this an opportune moment for US collectors to invest in Japanese Pokémon cards.

Weak Yen Advantage: The current weakness of the Japanese Yen significantly impacts the affordability of Japanese products for international buyers. This economic factor means that US collectors can acquire Japanese cards and sealed products at a reduced cost, effectively increasing their purchasing power. This creates a window of opportunity to acquire high quality Japanese assets at a lower entry point, potentially leading to higher returns when the Yen strengthens or demand continues its upward trajectory. Many astute investors are currently leveraging this "dip" in prices.

Growing Western Interest: There is a clear and accelerating trend of US collectors recognizing the value, quality, and unique appeal of Japanese cards. This shift in focus means that Japanese cards are no longer a niche interest but are becoming a regular part of many collectors' portfolios. This "new normal" of broader Western interest suggests sustained demand and continued market growth for Japanese Pokémon products.

Upcoming 30th Anniversary (2026): The Pokémon franchise's 30th Anniversary in 2026 is a highly anticipated milestone that is predicted to act as a significant market catalyst. This event is expected to "drive up prices for rare Japanese releases" , with auction houses and market analysts forecasting price increases of 30-50% for vintage and anniversary edition cards. This predictable market event allows investors to strategically acquire "vintage Japanese sets, particularly Base Set & Neo era cards" and "Japanese exclusive promos" before the anniversary, positioning themselves to capitalize on the anticipated surge in demand and appreciation. This is a classic example of anticipating market movements to maximize returns.

Key Japanese Investment Targets

For those looking to build a robust Pokémon card investment portfolio, certain types of Japanese cards consistently stand out as strong targets:

- Japanese Exclusive Promos: These cards are highly sought after due to their extreme rarity and often limited distribution. Notable examples include the Pikachu Illustrator card, which holds the record as the most expensive Pokémon card ever sold at $5.275 million , and the 2023 World Championships Pikachu promo, which has sold for over $1,500 in PSA 10 condition due to its exclusivity.

- High Grade Vintage Cards: First Edition and Neo era Japanese cards, particularly those in PSA 10 condition, are consistently strong performers. Their scarcity and historical significance drive their value.

-

Limited Print Modern Alternate Art Cards: Cards featuring popular Pokémon with stunning alternate artwork, such as the "Moonbreon" (Umbreon VMAX Alternate Art from Eevee Heroes), have seen significant appreciation. Charizard cards with unique art are also consistently valuable.

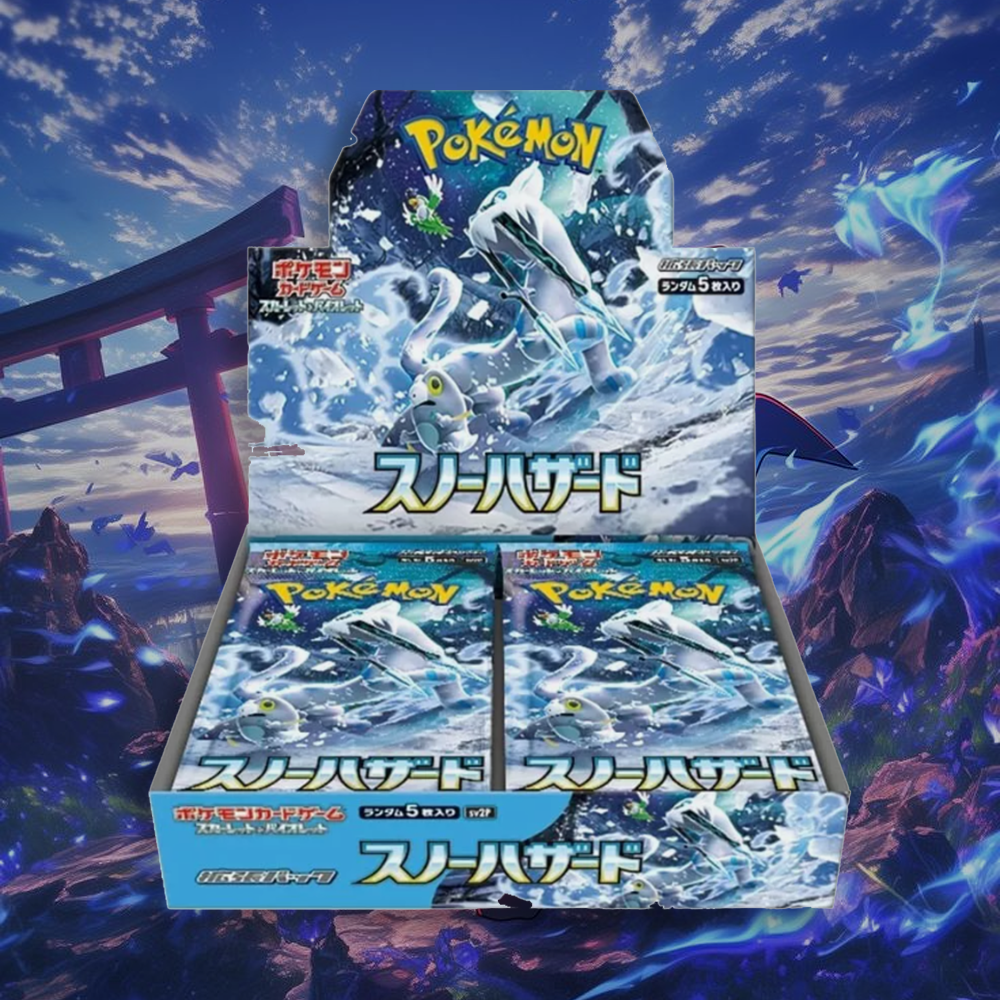

- Sealed Booster Boxes: Sealed boxes from older Japanese sets, especially from the EX and Diamond & Pearl eras (2003-2010), are becoming increasingly scarce and highly sought after by collectors and investors. Even more recent Japanese sets like Blue Sky Stream and Eevee Heroes have shown significant appreciation from their release prices.

Building Your Japanese Pokémon Investment Portfolio

A balanced approach to investing in Japanese Pokémon cards can maximize potential returns while managing risk. Experts often recommend a diversified portfolio strategy:

- Long Term Holds (60%): Focus on vintage PSA 10s, trophy cards, and sealed boxes. These assets tend to offer lower risk and higher stability, with gradual appreciation over 3-10+ years due to their inherent scarcity and historical significance.

- Mid Term Growth (30%): Target Japanese promos, limited releases, and high demand modern chase cards. These can offer significant growth potential, especially with the increasing Western demand for Japanese exclusives.

- Short Term Flips (10%): For more experienced investors, this category might include graded bulk, meta relevant TCG cards, or hype based investments. While offering the potential for quick gains, these assets also carry higher volatility.

Staying informed is paramount. Collectors and investors should closely monitor market trends, including potential reprints, anniversary editions, and population reports, as these can significantly influence supply and demand. Proactive monitoring of these trends is key to making strategic and profitable Pokémon TCG investments.

Japanese Pokémon Card Investment Portfolio Allocation

Conclusion: Seize the Opportunity

Japanese Pokémon cards represent a compelling investment opportunity for US collectors. Their superior quality, inherent exclusivity, and favorable market conditions driven by a weak Yen and growing Western demand create a unique environment for appreciation. By strategically targeting key assets and building a diversified portfolio, collectors can transform their passion into a smart financial endeavor. TrainerTier is committed to being a trusted partner on this investment journey, offering a carefully curated selection of authentic, high quality Japanese Pokémon cards to help collectors seize these opportunities.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.